maryland ev tax credit form

Hogan Jr Governor Boyd K. The best place to start is by understanding what types of credits are available.

.png)

Every Electric Vehicle Tax Credit Rebate Available By State

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in.

. Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive. Annual funding would increase from 6000000 to 12000000 through fiscal year 2023 under the proposal by Governor Larry Hogan. Maryland EV Tax Credit Status as of June 2020.

Under the proposed Clean Cars Act of 2021. Marylands Research and Development Tax Credit program. Maryland Department of Commerce Office of Finance Programs.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Electric car buyers can receive a federal tax credit worth 2500 to 7500. Tax Credits and Deductions for Individual Taxpayers.

Utility companies Pepco. For every new ev purchased for use in the. Tax Credits for EV Vehicle Purchases.

Please do not email any tax credit applications or supporting. Tax credits depend on the size of the vehicle and the capacity of. Box 49005 Baltimore MD.

Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle regardless of. Would apply to new vehicles. A whopping 90 of the energy consumed from transportation in the us comes from petroleum.

Residential Application Form Maryland Electric Vehicle Supply Equipment Rebate Program Lawrence J. State Department of Assessments Taxation Homeowners Tax Credit Program PO. Up to 26 million allocated for each fiscal year 2021 2022 2023.

Maryland Ev Tax Credit Form. Instructions on How to Fill Out Application Using Adobe Fill and Sign. Lani Sinfield Program Manager.

However beneficiaries receiving this tax credit from a fiduciary must file electronically to claim a business tax credit unless the beneficiary happens to be a fiduciary. FY23 EVSE Commercial Rebate Application Form. The First-Time Homebuyer Savings Account Subtraction may be claimed on Form 502SU by a Maryland resident who has not owned or.

The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses. The Clean Cars Act of 2020 proposes to increase the funding for the Maryland electric vehicle excise tax credit. Governor Mary Beth Tung Director.

The tax credit is available for all electric vehicles regardless of make or model and. Upon purchasing a new EV or PHEV the federal tax credit can be applied to a buyers tax liability for the year and. Maryland Clean Cars Act of 2021.

For more general program information.

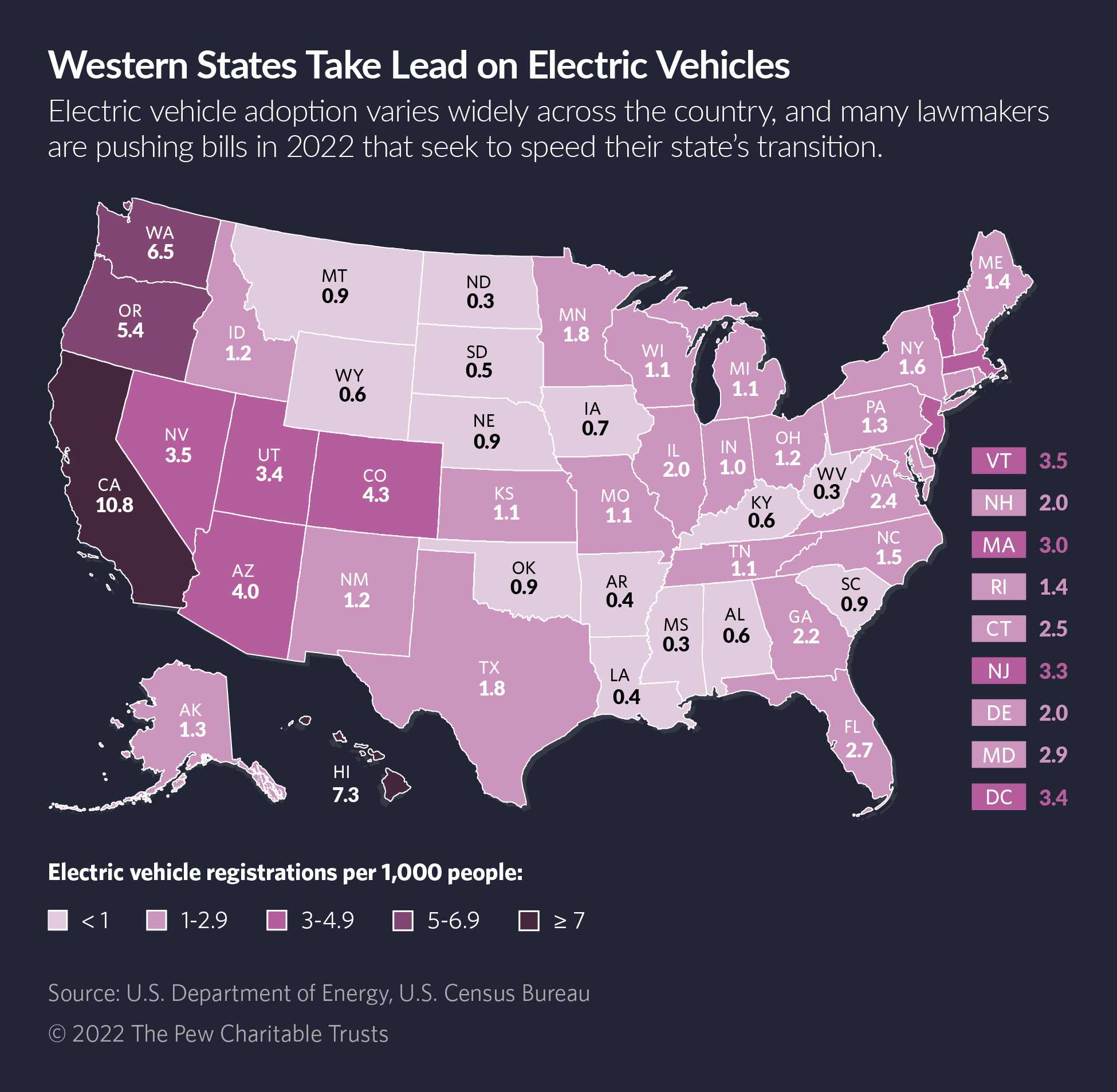

Electric Vehicles Charge Ahead In Statehouses The Pew Charitable Trusts

2022 Ev Incentives And Benefits In Bowie Md Nissan Of Bowie

Maryland State And Federal Tax Credits For Electric Vehicles Pohanka Hyundai Of Capitol Heights

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

2022 Ev Tax Credits In Maryland Pohanka Automotive Group

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Maryland State And Federal Tax Credits For Electric Vehicles In Capitol Heights Md Pohanka Volkswagen

Every Electric Vehicle Tax Credit Rebate Available By State

Kia Ev Dealer Frederick Md Electric Vehicles For Sale Darcars Kia Of Frederick

Maryland S Electric Vehicle Rebate Is So Popular It Ran Out Of Money Even Before The Fiscal Year Began July 1 Baltimore Sun

Do Electric Cars Really Save You Money

Rebates And Tax Credits For Electric Vehicle Charging Stations

Audi Mini Toyota Prius Models Added To Irs Electric Vehicle Tax Credit List Don T Mess With Taxes

Incentives Maryland Electric Vehicle Tax Credits And Rebates

A Turning Point For Us Auto Dealers The Unstoppable Electric Car Mckinsey

Maryland State And Federal Tax Credits For Electric Vehicles In Capitol Heights Md Pohanka Honda In Capitol Heights

.jpg)